The Main Principles Of Affordable Care Act (Aca) In Toccoa, Ga

Working does enhance the possibility that one and one's household members will certainly have insurance coverage, it is not an assurance. 1 percent uninsured rate) (Hoffman and Pohl, 2000).

1 and 3. 2 (Health Insurance in Toccoa, GA), for more details. New immigrants account for a substantial proportion of individuals without medical insurance. One evaluation has actually associated a significant portion of the current development in the dimension of the U - http://known.schwenzel.de/2015/fachblog-fr-irrelevanz.S. without insurance populace to immigrants who arrived in the nation in between 1994 and 1998 (Camarota and Edwards, 2000)

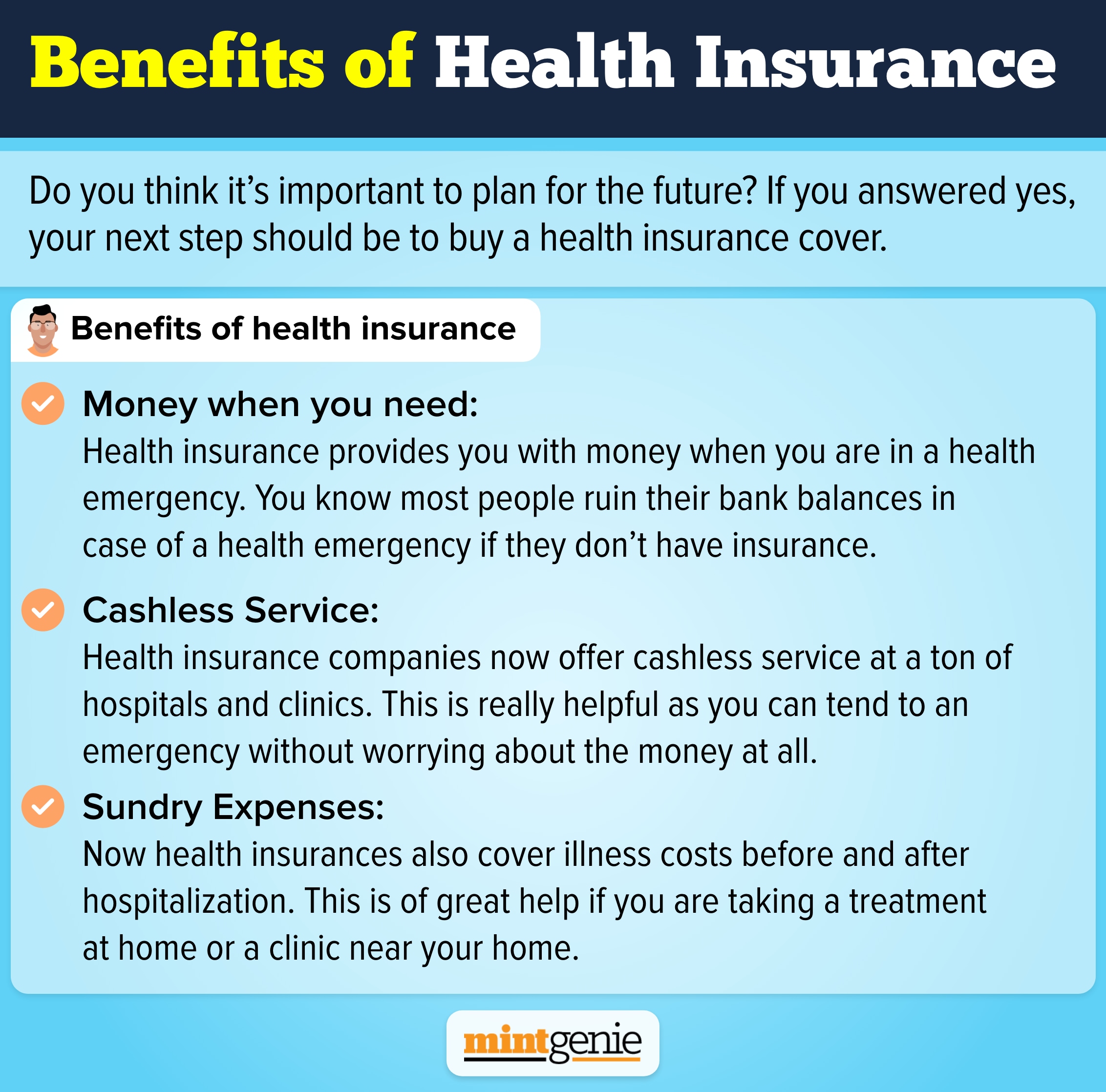

Wellness insurance insurance coverage is a crucial element in a lot of versions that portray accessibility to wellness care. The relationship between medical insurance and access to care is well established, as recorded later in this phase. Although the connection between medical insurance and health results is neither straight neither easy, an extensive scientific and health solutions study literature web links medical insurance coverage to enhanced accessibility to care, far better high quality, and boosted individual and populace health and wellness standing.

An Unbiased View of Affordable Care Act (Aca) In Toccoa, Ga

The issues faced by the underinsured are in some areas similar to those faced by the without insurance, although they are typically much less serious. Wellness insurance, nevertheless, is neither needed neither sufficient to get access to medical services. The independent and direct result of wellness insurance protection on access to health solutions is well developed.

Others will acquire the healthcare they need also without medical insurance, by spending for it expense or seeking it from service providers that provide care free or at extremely subsidized rates - Health Insurance in Toccoa, GA. For still others, wellness insurance coverage alone does not guarantee receipt of care since of various other nonfinancial barriers, such as an absence of health care suppliers in their community, minimal access to transportation, illiteracy, or linguistic and social differences

Affordable Care Act (Aca) In Toccoa, Ga Can Be Fun For Everyone

Formal study about uninsured populations in the United States dates to the late 1920s and very early 1930s when the Board on the Cost of Treatment created a series of records concerning financing physician office sees and hospitalizations. This concern came to be prominent as the numbers of medically indigent climbed throughout the Great Anxiety.

Empirical studies regularly sustain the link in between access to care and boosted health and wellness outcomes (Bindman et al., 1995; Starfield, 1995). Having a normal source of care can be taken into consideration a predictor of accessibility, instead than a direct procedure of it, when health outcomes are themselves used as gain access to indications. Automobile Insurance in Toccoa, GA. This extension of the notion of accessibility measurement was made by the IOM Board on Checking Accessibility to Personal Health And Wellness Treatment Provider (Millman, 1993, p

However, the influence of moms and dads' health and wellness and medical insurance on the health of their children has received interest just recently. Whether or not parents are guaranteed shows up to affect whether their youngsters receive care as well as just how much careeven if the kids themselves have protection (Hanson, 1998).

About Life Insurance In Toccoa, Ga

Emergency situation divisions are depicted as an expensive and inappropriate website of primary treatment solutions, several uninsured individuals seek treatment in emergency divisions since they are sent there by various other wellness care companies or have nowhere else to go. Emergency treatment specialists say that the country's emergency situation departments not just function as carriers of last hope however are an important access point right into the health and wellness treatment system (O'Brien et al (http://www.mappery.com/user.php?name=jstinsurance1#)., 1999)

Phase 2 offers a review of just how employment-based health insurance coverage, public programs and specific insurance coverage operate and interact to provide extensive but insufficient insurance coverage of the united state populace. This consists of a testimonial of historic patterns and public laws impacting both public and exclusive insurance policy, a conversation of the interactions among the different kinds of insurance coverage, and an exam of why people move from one program to another or end up with no browse around these guys coverage.Chapter 3 manufactures existing info to get here at a composite description of the uninsured: What characteristics do individuals without protection typically share? Where do the without insurance real-time? The phase additionally provides details regarding the threat of being or coming to be uninsured: How does the opportunity of being uninsured adjustment depending on chosen qualities, such as racial and ethnic identification, rural or city residency, and age? What are the likelihoods for specific populaces, such as racial and ethnic minorities, rural homeowners, and older working-age individuals, of being uninsured? How does the opportunity of being uninsured adjustment over a life time? In enhancement to characterizing the chance of being uninsured in regards to a solitary dimension, such as gender, age, race, job condition, or geographic area, Phase 3 Provides the outcomes of multivariate evaluations that supply a more insightful depiction of the variables that contribute to the possibilities of being without insurance.